December 12, 2024

December 12, 2024

1k+ IRR

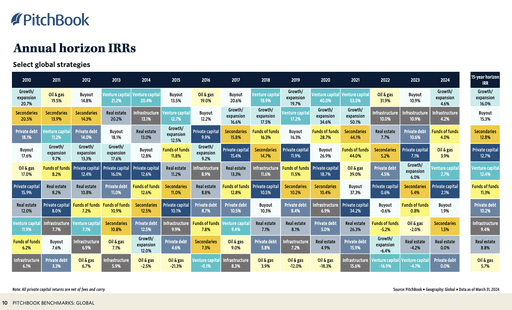

This graph (Pitchbook) tracks private / alternative asset class returns since 2010. VC ranked best performing asset class in a few vintages at ~20% IRR, and 2020 and 2021 notably hit 40% and 50% respectively. On a 15 year horizon, average IRR spans 5-16%, VC and PE sitting somewhere in the middle of that. Just as a comparison the S&P 500 returned about 13% in the last 10 years. The market processes these returns as "good." I found a way to crank those rates by almost 100x… achieving 1K+% IRR on the internet (but it's hard to scale).

I'm known for internet arb; a legitimate addiction to finding underpriced items and either flipping them or keeping them as part of a portfolio of collectible assets. Most purchases are long-term holds, but I cashed a few exits recently. A waffle interior Chrome Hearts sweatshirt purchased from a t-shirt dealer in LA for $140 in 2019 sold for $700 on TheRealReal last week. I made $578 post commission, representing 37% IRR. In other categories like furniture, I recently sold a George Nelson table on Ebay, 53% IRR. I originally found it in 2019 at a furniture warehouse in Chicago.

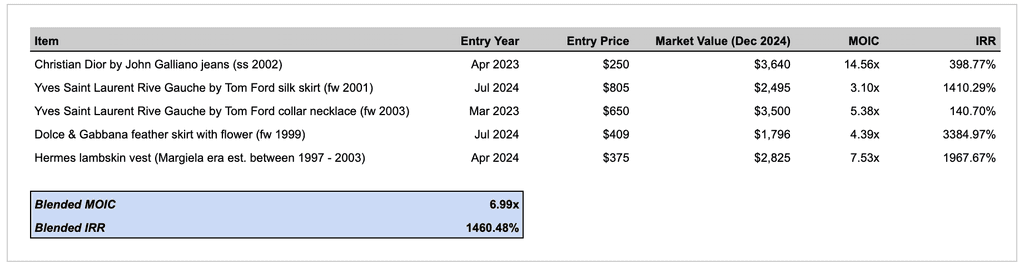

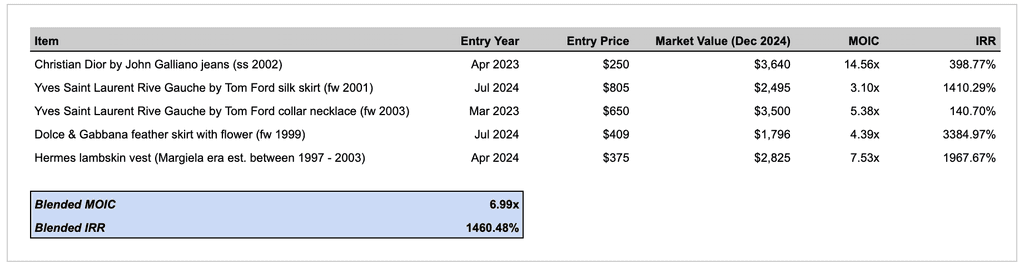

This is the mark to market on my current portfolio (unrealized gains). I derived current market value from recent transactions of the same item, or current listings of the same item. I realize that current listing prices might not be a perfect representation of the market clearing price (transaction hasn’t cleared yet), but assume that it represents at least a close proxy for current market value.

I’ve also sold at a loss. A week ago, I sold a pair of 2000s Chanel denim shorts for $316 on TheRealReal. I bought them on Ebay in September 2023 for $406. My commission was only $193, so basically I made half the investment back. At this point, I know pricing algorithms on the platforms well enough to have anticipated the loss. I wanted cash back fast, so optimized for listing convenience over value. TRR is a managed service – they do the work for you in exchange for higher commission. If I were optimizing for price I would have liquidated on a resale platform with lower take rates.

Analyzing the true value of things, rather than the market value of things, underpins dealmaking (investing) of any kind… buying a house, hiring employees, trading stocks. If I’m hiring an engineer, how do I know I’m not overpaying? If I am overpaying, I should know for certain that I am overpaying, and why I am willing to do so. Maybe I believe the rest of the market still undervalues this person, even at my high clearing price. Inversely, good traders buy at the dip; they have a long term view on the true value of the underlying asset when the market consensus says something different. What this approach really takes is having done the work to innately understand the asset, know how the market prices it without needing to double check your instinct. Transacting of any kind builds a proficiency in assessing the actual value of everything. Below I tried to distill the aspects of internet dealmaking that transpose horizontally to all types of investing.

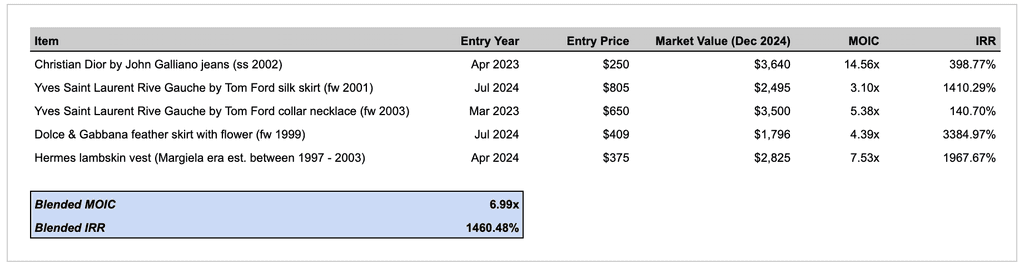

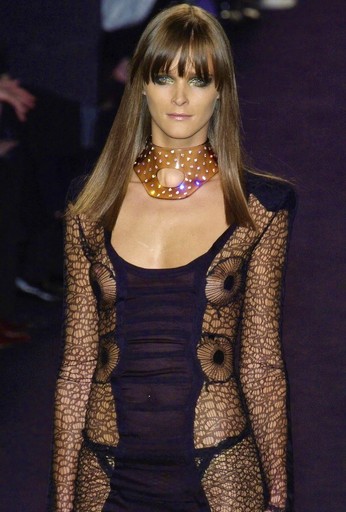

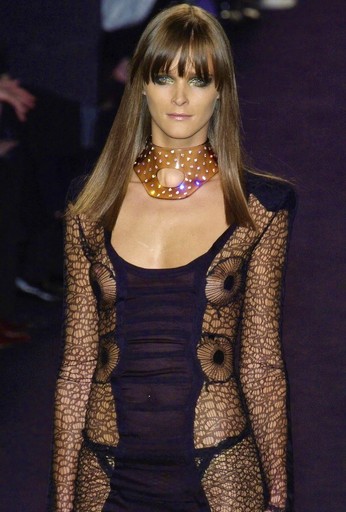

Develop an instinct for value by sifting large amounts of data. Knowledge of historical style trends, recursive price movements, important individuals who contributed to the evolution of the field contributes to an understanding of where value sits in the market and why. In clothes for example, Dior designed by John Galliano is always priced higher than Dior designed by Hedi Slimane. While Tom Ford is a famous clothing designer himself, the items under his own brand (Tom Ford) do not hold value, while the items he designed for Gucci in the 1990s or Yves Saint Laurent in the early 2000s command some of the highest premiums in the market. If brands that are currently popular point to an aesthetic trend such as minimalism (i.e. The Row), past collections or time periods that also emphasized that aesthetic (i.e. 1990s Prada) will likely be popular in the following season. Logically, you would purchase pieces on the low ahead of that anticipated market spike. There are also coveted items tied to specific designers and time periods. For example, horse motifs symbolize Tom Ford era Gucci and therefore major $$ return potential. These are long-term holds; rare pieces that are unlikely to decrease in value. Underpriced inventory in this category is nearly impossible to find, and when it surfaces the process is competitive. Winning the item typically requires acting quickly in order to preserve a low entry price, before the seller realizes the true value or before another buyer pounces. Showing up with existing knowledge enables fast decision making – no research needs to be done to validate the merit of the transaction. I found this necklace at a shop in Miami last year and quickly categorized the item from a picture I had seen from an Yves Saint Laurent runway collection. I negotiated the price as low as possible to $650 and walked out knowing the market value of my item was 6x what I paid for it.

Know where to hunt. Sometimes, deals can be made in real life, but the best deals I believe are on the internet, and the best buyers know what waters to swim in to find the arbitrage. Ebay and other resale platforms with especially high volumes of inventory like TheRealReal and Vestiaire Collective are great. Most people won’t work to sort through the information, so getting creative with ways to parse basically infinite data is the opportunity. You have to love this chase. I like to think about it like a game universe, where testing different permutations and combinations leads you to treasure. I automate searches for keywords like “19” and “20” because that flags anything tagged in the 1990s or 2000s timeframe (high value frequently underpriced, like the Chanel shorts mentioned above). Other resale platforms intuitively seem like the right waters but are not the place to find deals. I would never hunt on 1stdibs; the comparatively small liquidity pool is not optimal for value buyers, but it’s a great place to sell items to curators and collectors who are less price sensitive.

Creative dealmaking, strict negotiation. Set a price limit beforehand and do not cross it. Admittedly I’m not perfect at this, especially when I find things that I personally want (searching for years, will I find it again?) and start stretching purchase price. That’s when it gets emotional and not the right mental state to be dealmaking. A good dealmaker has the ability to walk away, knowing that a transaction might still clear with patience or through an alternative deal structure that satisfies both parties. I’ve gotten good at this part – over the years I’ve encrypted messages on Ebay in order to meet in person and transact with cash, found a seller’s personal email on another site to avoid commission and propose a direct transaction via wire transfer, and sometimes just lowballed for months until they finally give in. The most satisfying component of the process for me is this, winning a great deal * and in return owning something that I love, that I know represents greater future value.

In the new year, I’m going to more deliberately build an investment portfolio of collectibles with the idea of generating a meaningful return on those assets by year end. I’ll start with a $1,500 budget and work upwards as I purchase and sell items accordingly. Will intermittently post updates on how it’s going here.

Current holdings as marked in market:

Portfolio:

(art by Gary Lang)

I’ve also sold at a loss. A week ago, I sold a pair of 2000s Chanel denim shorts for $316 on TheRealReal. I bought them on Ebay in September 2023 for $406. My commission was only $193, so basically I made half the investment back. At this point, I know pricing algorithms on the platforms well enough to have anticipated the loss. I wanted cash back fast, so optimized for listing convenience over value. TRR is a managed service – they do the work for you in exchange for higher commission. If I were optimizing for price I would have liquidated on a resale platform with lower take rates.

Analyzing the true value of things, rather than the market value of things, underpins dealmaking (investing) of any kind… buying a house, hiring employees, trading stocks. If I’m hiring an engineer, how do I know I’m not overpaying? If I am overpaying, I should know for certain that I am overpaying, and why I am willing to do so. Maybe I believe the rest of the market still undervalues this person, even at my high clearing price. Inversely, good traders buy at the dip; they have a long term view on the true value of the underlying asset when the market consensus says something different. What this approach really takes is having done the work to innately understand the asset, know how the market prices it without needing to double check your instinct. Transacting of any kind builds a proficiency in assessing the actual value of everything. Below I tried to distill the aspects of internet dealmaking that transpose horizontally to all types of investing.

Develop an instinct for value through infinite learning. Acquiring knowledge requires seeing millions of data points over time. Studying historical style trends, recursive price movements, important individuals who contributed to the evolution of the field builds toward an academic understanding of where value sits in the market and why. In clothing for example, Dior designed by John Galliano is always priced higher than Dior designed by Hedi Slimane. While Tom Ford is a famous clothing designer himself, the items under his own brand (Tom Ford) do not hold value, while the items he designed for Gucci in the 1990s or Yves Saint Laurent in the early 2000s command some of the highest premiums in the market. If brands that are currently popular point to an aesthetic trend such as minimalism (i.e. The Row), past collections or time periods that also emphasized that aesthetic (i.e. 1990s Prada) will likely be popular in the following season. Logically, you would purchase pieces on the low ahead of that anticipated market spike.

There are also coveted items tied to specific designers and time periods. For example, horse motifs symbolize Tom Ford era Gucci and therefore major $$ return potential. These are long-term holds; rare pieces that are unlikely to decrease in value. Underpriced inventory in this category is nearly impossible to find, and when it surfaces the process is competitive. Winning the item typically requires acting quickly in order to preserve a low entry price, before the seller realizes the true value or before another buyer pounces. Showing up with existing knowledge enables fast decision making – no research needs to be done to validate the merit of the transaction. I found this necklace at a shop in Miami last year and quickly categorized the item from a picture I had seen from an Yves Saint Laurent runway collection. I negotiated the price as low as possible to $650 and walked out knowing the market value of my item was 6x what I paid for it.

Know where to hunt. Sometimes, deals can be made in real life, but the best deals I believe are on the internet, and the best buyers know what waters to swim in to find the arbitrage. Ebay and other resale platforms with especially high volumes of inventory like TheRealReal and Vestiaire Collective are great. Most people won’t work to sort through the information, so getting creative with ways to parse basically infinite data is the opportunity. You have to love this chase. I like to think about it like a game universe, where testing different permutations and combinations leads you to treasure. I automate searches for keywords like “19” and “20” because that flags anything tagged in the 1990s or 2000s timeframe (high value frequently underpriced, like the Chanel shorts mentioned above). Other resale platforms intuitively seem like the right waters but are not the place to find deals. I would never hunt on 1stdibs; the comparatively small liquidity pool is not optimal for value buyers, but it’s a great place to sell items to curators and collectors who are less price sensitive.

Creative dealmaking, strict negotiation. Set a price limit beforehand and do not cross it. Admittedly I’m not perfect at this, especially when I find things that I personally want (searching for years, will I find it again?) and start stretching purchase price. That’s when it gets emotional and not the right mental state to be dealmaking. A good dealmaker has the ability to walk away, knowing that a transaction might still clear with patience or through an alternative deal structure that satisfies both parties. I’ve gotten good at this part – over the years I’ve encrypted messages on Ebay in order to meet in person and transact with cash, found a seller’s personal email on another site to avoid commission and propose a direct transaction via wire transfer, and sometimes just lowballed for months until they finally give in. The most satisfying component of the process for me is this, winning a great deal * and in return owning something that I love, that I know represents greater future value.

In the new year, I’m going to more deliberately build an investment portfolio of collectibles with the idea of generating a meaningful return on those assets by year end. I’ll start with a $1,500 budget and work upwards as I purchase and sell items accordingly. Will intermittently post updates on how it’s going here.

Current holdings as marked in market:

Prada 1995

Dolce & Gabbana 1999

Gucci 2003

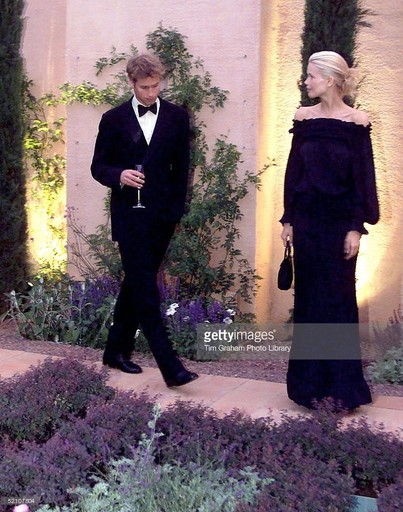

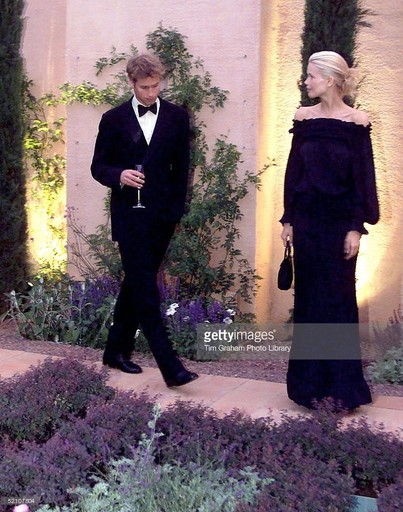

Yves Saint Laurent 2001

The Row 2020

Prada 1995

The Row 2020

Dolce & Gabbana 1999

Yves Saint Laurent 2001

Gucci 1993